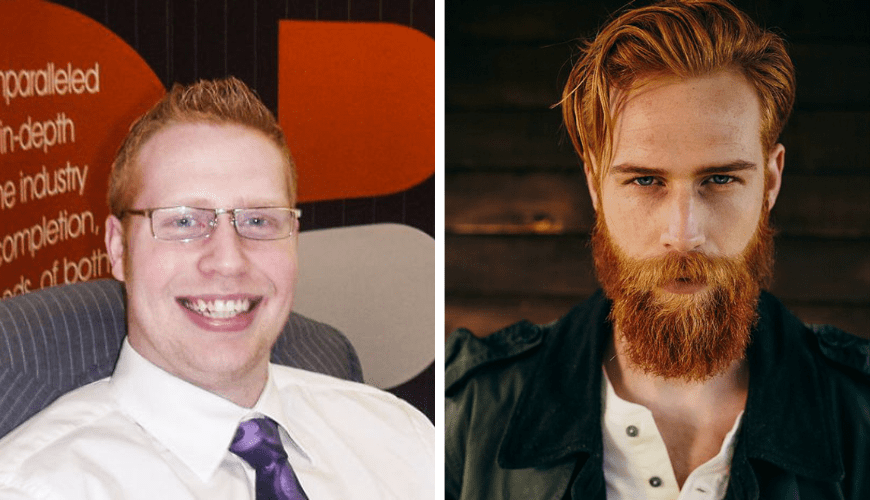

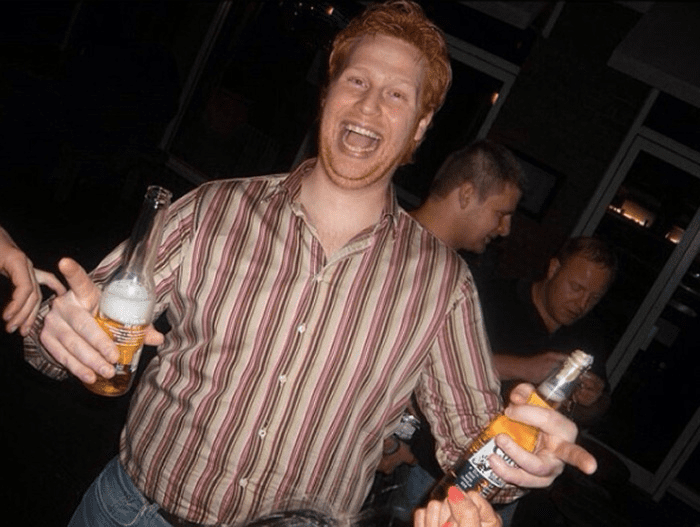

Meet Gwilym Pugh, a 21-year-old businessman who started a successful insurance company in his home office. But life took a toll on him as he gained much weight, reaching 280 pounds. However, his life turned positive after his barber encouraged him to grow a ginger beard.

Gwilym explained, “At that time, I was pretty overweight, working long hours, and dealing with injuries that prevented me from staying active. My business was doing okay, but I realized I needed to get my life back on track and become healthier.”

A few years ago, Gwilym and his friends formed a folk band. His barber suggested growing a beard to match his new look. Alongside this change, he decided to clean up his diet. However, the most significant change was leaving his desk job.

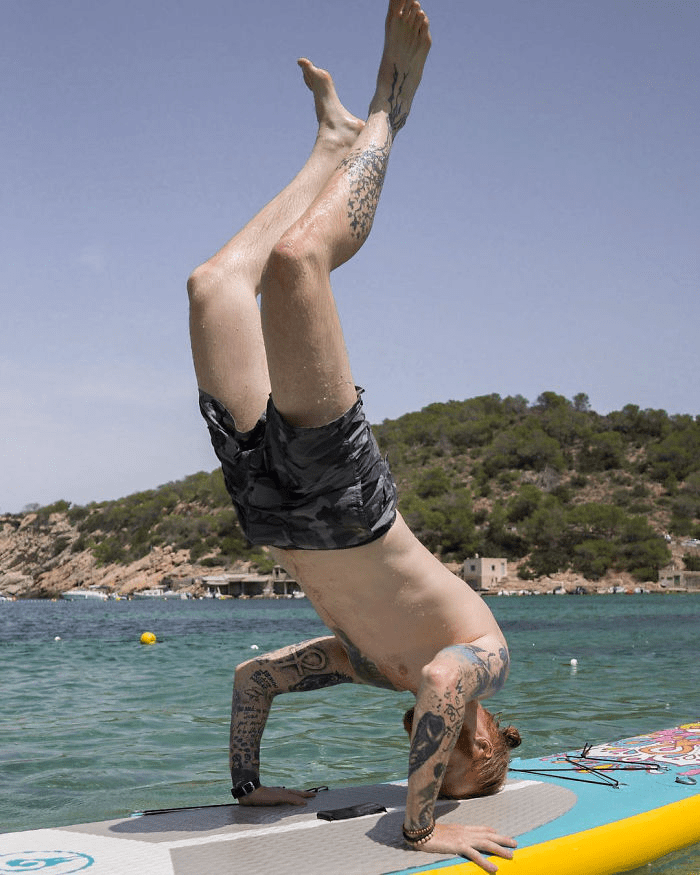

“It was the best thing for my health because I stopped sitting for nine to ten hours a day,” said Gwilym, who lost 90 pounds over five years. During his weight loss journey, he created an Instagram account. Eventually, a Welsh tailor named Nathan Palmer discovered his photos, and things started happening quickly.

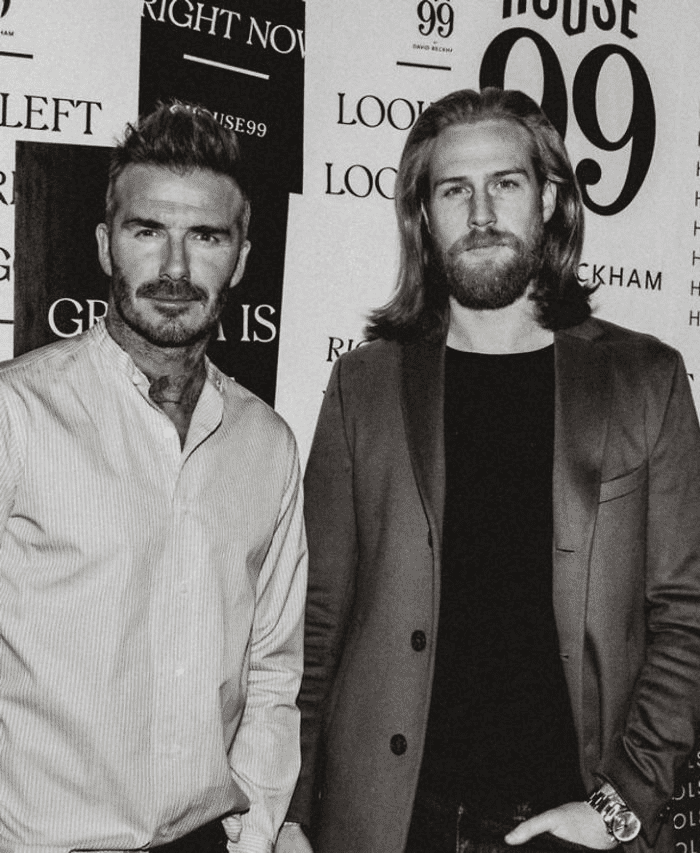

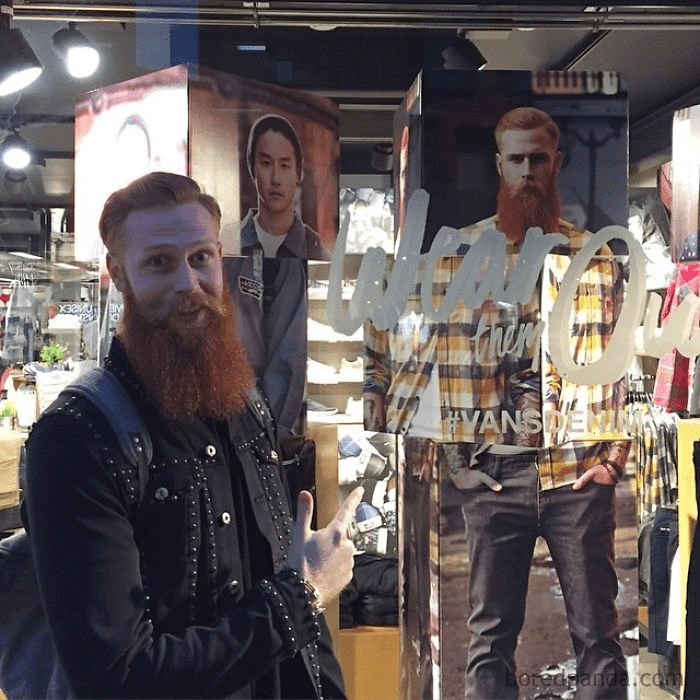

Today, Gwilym is represented by the London agency AMCK Models and has worked on campaigns with big names like Vans, Bud Light, and Diesel. He even became an ambassador for David Beckham’s new male grooming brand, House 99!

Looking at Gwilym Pugh’s inspiring transformation, you might find the motivation to make positive changes in your own life.

More info: Instagram

#1

#2

#3

Understanding Life Insurance: Protecting Your Loved Ones

Life insurance may sound complicated, but it’s really about taking care of the people you love. In this article, we’ll break it down into simple terms so that even high school students can grasp the basics.

Introduction to Life Insurance

Life insurance is like a financial safety net for your family. It’s a special kind of contract you make with an insurance company.

Types of Life Insurance Policies

- Term Life Insurance – Consider renting insurance for a specific time, like 10 or 20 years. It’s affordable and straightforward. If you pass away during the term, your loved ones get a payout.

- Whole Life Insurance – This is like owning insurance for your entire life. It’s more expensive, but it also builds cash value over time. Your family gets money when you’re gone.

- Universal Life Insurance – It’s flexible, allowing you to change your premiums and death benefits. Part of your payments go into an investment account.

#4

#5

#6

#7

Components of a Life Insurance Policy

- Premium – The money you pay for insurance.

- Death Benefit – The money your family gets when you pass away.

- Cash Value – Only in some policies, like whole life. It’s like a savings account.

- Policy Term – How long your insurance lasts.

- Riders and Endorsements – Extra options for your policy.

#8

#9

#10

#11

The Application Process

When you want life insurance, you must answer some questions about your health and lifestyle. In some cases, you might even get a medical check-up. The insurance company uses this information to set your premiums.

#12

#13

Choosing the Right Life Insurance Policy

To pick the proper insurance, consider your family’s needs and what you can afford. You can compare different policies and talk to an insurance agent for guidance.

#14

#15

Beneficiaries

Your beneficiaries are the people who will receive the money when you’re gone. You can choose primary and contingent beneficiaries and change them if needed.

Policy Ownership and Rights

You own your policy, and you can make decisions about it, like changing beneficiaries or borrowing money from it.

Premium Payments

You need to pay your premiums regularly. If you miss a payment, you might have a grace period to catch up.

Policy Lapse and Surrender

If you stop paying premiums, your policy may lapse or be surrendered. This means you might lose your coverage or the cash value.

Death Benefit Payout

Your family can receive the life insurance money in different ways, like a lump sum or instalments. This money can help them pay bills, cover expenses, or save for the future.

Tax Implications

Most of the time, the money your family gets from life insurance is tax-free. But there are some exceptions, so it’s good to know about them.

Importance of Life Insurance

Life insurance is vital for financial security. It helps protect your loved ones when you’re no longer around. It can cover debts, provide an income, and ease the burden in tough times.

#16

#17

Common Myths and Misconceptions

- You don’t have to be rich to get life insurance.

- Even if you’re young and single, it can still be a good idea.

- You might need more than just your work’s insurance.

In a nutshell, life insurance is about caring for your family’s future. It’s not as complicated as it may seem, and it can make a big difference during challenging times. Take the time to understand it and make the right choice for your family’s needs.

Remember, when it comes to life insurance, it’s better to have it and not need it than to need it and not have it.

#18

#19